REMA Second Consultation: What comes next?

Launched in 2022, the ongoing Review of Electricity Market Arrangements (REMA) offers a menu of potential changes to the structure of the UK’s electricity markets. REMA will constitute the largest change to UK energy markets in decades and aims to enable the decarbonisation of the UK’s electricity system over the coming years, while ensuring that the benefits of a clean electricity system are passed onto consumers.

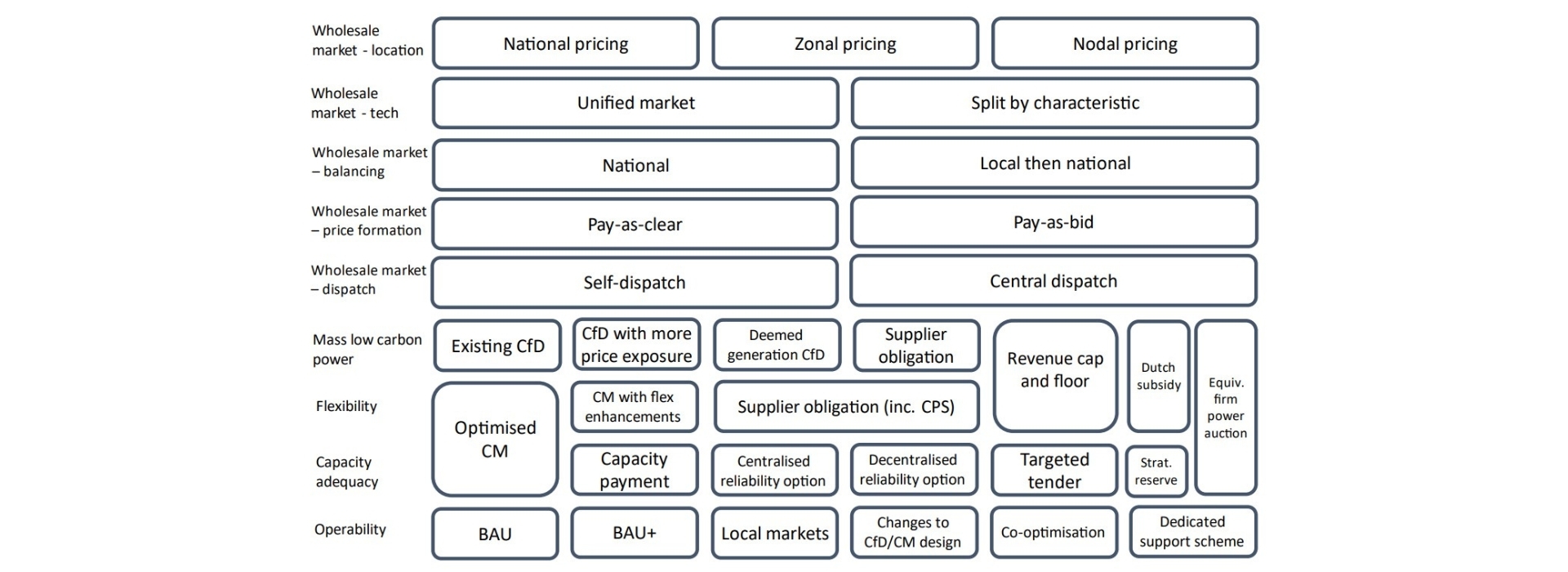

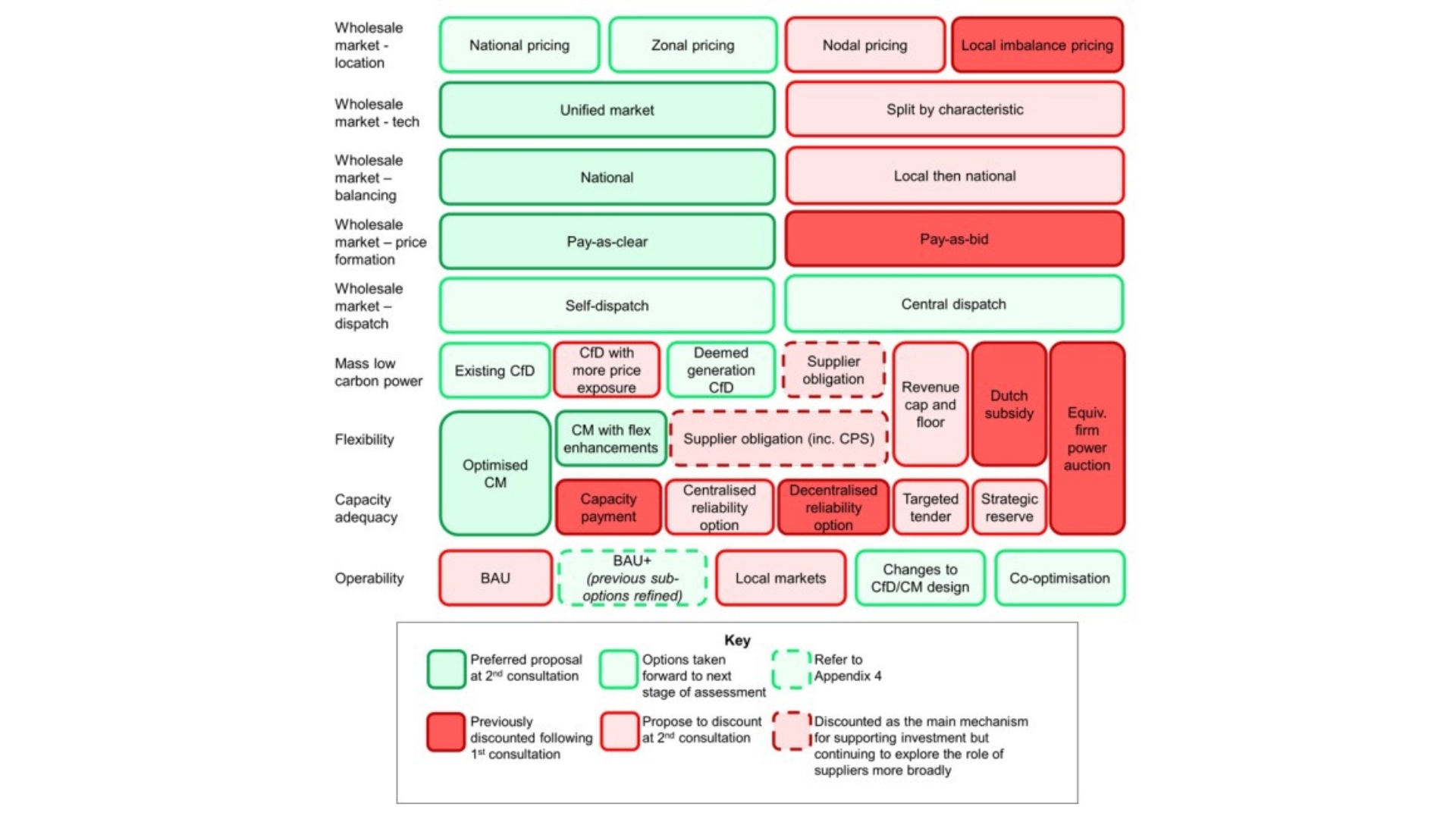

This month, government released the second REMA consultation, which outlined some of the initial positions that government is minded to take. Whilst this consultation ruled out some of the riskier options within REMA, such as nodal pricing, it leaves several tricky decisions on the table for a future government. Figures 1 and 2 below show how the options have narrowed from the first to the second consultation.

Reform, not Revolution

The decision to rule out relatively maverick measures such as split markets or a Green Power Pool will be re-assuring to investors looking for stability, but it now looks inevitable that the tough decisions around proposals such as zonal pricing will be pushed onto the next Government.

Zonal pricing – where electricity pricing is split into defined regional ‘zones’ based upon network constraints – is one of the most notable proposals. The consultation document shows that the additional variation in annual household electricity bills caused by zonal pricing could be as high as £84. How government presents this change to households in areas with higher pricing will be an important consideration and communications challenge.

Overall, the consultation emphasises reform, not revolution. Retaining marginal pricing across the wholesale market, and future-proofing the CfD scheme, show a more pragmatic approach to decoupling the price of gas and electricity.

Moving away from more radical reforms will reduce much of the investment uncertainty, but groups such as Renewable UK and Solar Energy UK have flagged initial concerns that some of the measures, including zonal pricing, still present challenges to investment in the energy transition. Other industry players have broadly welcomed the consultation, and whilst there is lively debate on some aspects, further clarity on timescales has been warmly received.

Spin v. Substance

Notably, government’s announcement of the consultation did not focus on the importance of investment in the energy transition, but rather was framed around the role of gas in supporting UK energy security.

A press release issued by the Department for Energy Security and Net Zero focused on the importance of unabated gas in keeping the lights on, and actions within the REMA consultation to boost gas power capacity in the UK. This is, however, at odds with the detail.

Analysis put forward by government in Parliament shows that unabated gas will be around 1% of the UK’s energy supply by 2035. To add to that, the actual proposals put forward in the consultation don’t seem to provide additional support for the development of new-build unabated gas power stations. What REMA does provide, via reforming the Capacity Market (CM), is continued support for some existing some gas-fired power stations, and new bespoke support for gas power with CCS, and hydrogen-to-power stations.

REMA is fundamentally about supporting energy consumers, and creating effective markets that enable the net zero transition, rather than the role of gas power.

Politics is Central

The framing around gas is of course political. Labour’s plan to decarbonise the power sector by 2030 is incredibly ambitious – so much so that few analysts can show a credible route to this target. The Conservatives are looking to discredit the target and create a narrative that such a rapid energy transition risks blackouts and sky-high energy prices. The intricacies of decarbonisation policy are hard to grasp for the general public, and the narrative around blackouts could prove be potent and capture imaginations on the doorstep. However, for now, Labour’s headline policy of a publicly owned energy company remains popular, and the difference between a 2030 v 2035 decarbonisation target is taking a backseat against the cost-of-living crisis and social issues in the eyes of most voters.

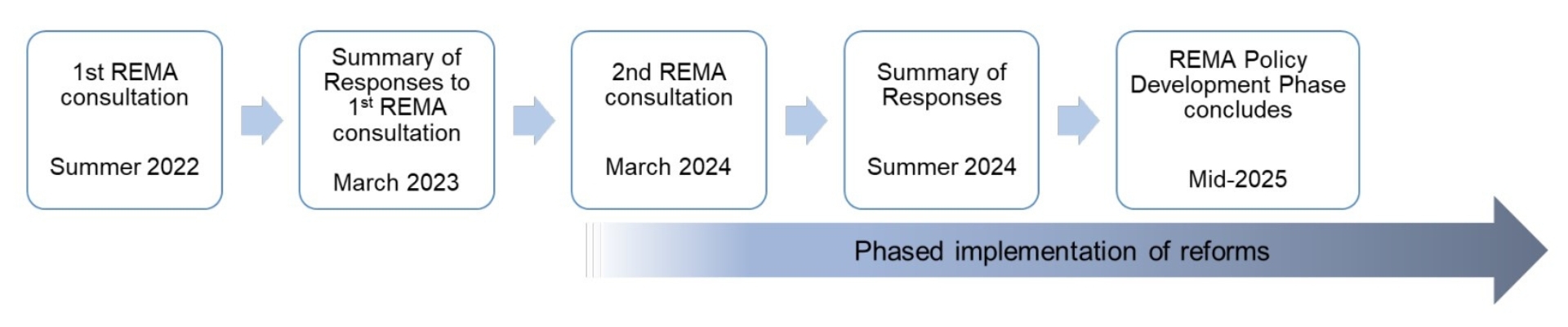

For REMA, the government response to the consultation will be published in the summer, which will likely make some further detailed commitments, but the set piece decisions will be made by the next Government, when the REMA policy development phase concludes in Mid-2025. There is significant frustration from developers and investors that delaying the timeframe for decisions is creating yet further uncertainty, and a general election adds more uncertainty to the mix.

It is probable that final decisions around REMA will be in the hands of a Labour Government. While the Labour Party is just beginning to formulate thoughts on REMA, we understand that they are cautious for now on high-risk changes, and REMA is not politically salient enough for us to expect any detail in the upcoming manifesto. They will need to act decisively on REMA, however, to keep on track for the 2030 decarbonisation target. With the implementation phase expected to take at least 12 months, it leaves less than a handful of years for REMA to contribute towards to the party’s 2030 target. The party needs to be prepared to act within the first 100 days, to swiftly deliver reforms that will unlock investment in the energy transition, and provide stability to the market.

Shaping the Future of Energy Markets

For energy companies in the UK, there remains an important opportunity to engage with REMA. Beyond the consultation document, key players in the energy space, particularly the Labour Party, are open to ideas and thinking on what the final set of reforms look like. Now is the time to be emphasising the importance of stability and gradual reform, particularly ahead of what we expect to be a turbulent election season. Madano is working closely with decisions makers at a political, civil service, and wider influencer level, to ensure that the final package is effective, provides stability, and drives forward ambition on net zero.

If you have any concerns about how REMA could impact your organisation, feel free to reach out to a member of Madano’s specialist Net-Zero Team at [email protected].